Although Massachusetts leads the nation with the lowest rates of uninsurance, residents who are male, single, young, and low-income are more likely than others to be persistently without health insurance for two consecutive years. This was one of the findings of a report co-authored by researchers from UMass Medical School and the Commonwealth Health Insurance Connector Authority and funded by the Blue Cross Blue Shield of Massachusetts Foundation. The findings suggest that a variety of approaches are needed to reduce the number of residents who remain without health insurance.

Massachusetts Residents Without Health Insurance Coverage: Understanding Those at Risk of Long-Term Uninsurance, released July 14, supports previous analyses of single-year data that indicated young adult, male, low-income populations represent a disproportionate share of the uninsured. This study found they also represent a disproportionate share of the persistently uninsured population that was uninsured over two consecutive years.

The report was co-authored by Michael Chin, MD, assistant professor of UMass Medical School’s Department of Family Medicine and Community Health and a health policy associate in the Research and Evaluation Unit within the school’s Commonwealth Medicine division; and Audrey Gasteier, MS, director of Policy & Outreach at the Commonwealth Health Insurance Connector Authority.

Researchers used state tax filings for 2011 and 2012 to quantify and understand individuals in Massachusetts who may be persistently uninsured for both of these years, information that previously had not been known. State officials have reported that between 2008 and 2012, more than 140,000 tax filers each year have been without full-year health insurance, even though two-thirds of this population had income levels low enough that most should have been eligible for free or low-cost health insurance. This situation raises important questions that previously had not been answered, such as: How many of the uninsured in an individual year remain persistently uninsured in the following year?

The authors said the results of the analysis will help inform health care providers, community organizations, advocates and policymakers who want to reach those who are uninsured or at risk of becoming uninsured.

Key findings of the study include:

- The large majority – 97 percent – of adults who had health insurance for the full year in 2011 continued to be insured for the full year in 2012.

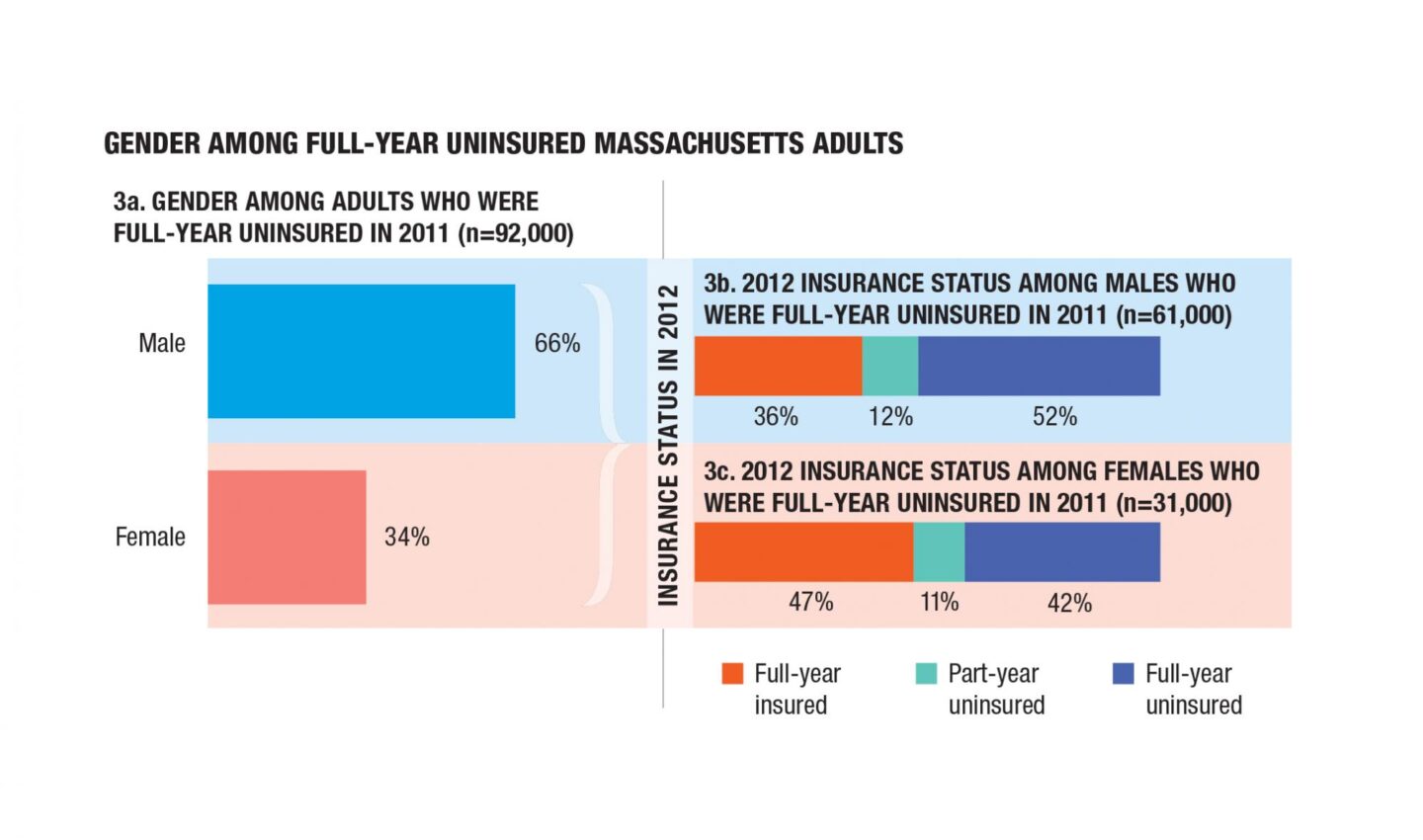

- About 180,000 adults were uninsured for all of 2011, and among these individuals 60,000 were persistently uninsured for the following year.

- Tax filers who were uninsured for all or part of 2011 were more likely than full-year insured individuals to experience uninsurance in the following year.

- The rate of full-year uninsurance varied among counties in the state, with Nantucket, Dukes, Barnstable and Suffolk counties having the highest rates of full-year uninsurance in 2011. Counties with the highest rates of full-year uninsurance also had the highest rates of persistent uninsurance, ranging from 1 to 5 percent.

The authors suggest that report’s findings may help other state and national leaders. Data about health insurance status from federal tax filings, which began to be collected in 2015 as a result of the Affordable Care Act, could be used for analyses similar to the ones in the report, not only on a national level, but for states, counties and communities nationwide.

This study is a follow-up to one released in February that highlighted some of the major reasons that approximately 200,000 Massachusetts residents remain uninsured 10 years after the state’s health care reform law passed. That report, titled The Remaining Uninsured in Massachusetts: Experiences of Individuals Living without Health Insurance Coverage, found that the cost of health insurance and difficulties with the application process are among the major reasons for uninsurance in Massachusetts.